Glencore secrets revealed

The dodgy operations of the world’s largest mining company are a single slice of thousands of revelations coming to light in the Paradise Papers – over 13 million leaked documents from law firms and associated entities in international tax havens.

Here is an explainer of the emerging scandal, being dished out by writers from the International Consortium of Investigative Journalists (ICIJ).

The documents detail how mining magnate Dan Gertler held Glencore’s imprimatur as key negotiator with authorities from the Democratic Republic of the Congo (DRC).

Glencore was shown to have secretly loaned tens of millions of dollars to Mr Gertler, an Israeli billionaire, to secure a controversial mining agreement in the DRC in 2009.

Mr Gertler is well-known in the resource-rich but conflict-ridden region, including being named in a 2001 UN investigation as the source of a $20 million loan to DRC president Joseph Kabila that was use for weapons to equip Mr Kabila’s army against rebel groups.

Mr Gertler is alleged to have received a monopoly on the country’s diamonds in return.

Additionally, a 2013 Africa Progress Panel report highlighted a string of mining deals linked to him that deprived the DRC of over $1.3 billion in potential revenue.

The billionaire was also one of several linked to over $100 million in bribes paid over a decade to DRC government officials “to obtain special access to and preferential prices for opportunities” in the mining sector, on behalf of a US hedge fund.

Mr Gertler’s lawyers say he categorically denies the latest allegations.

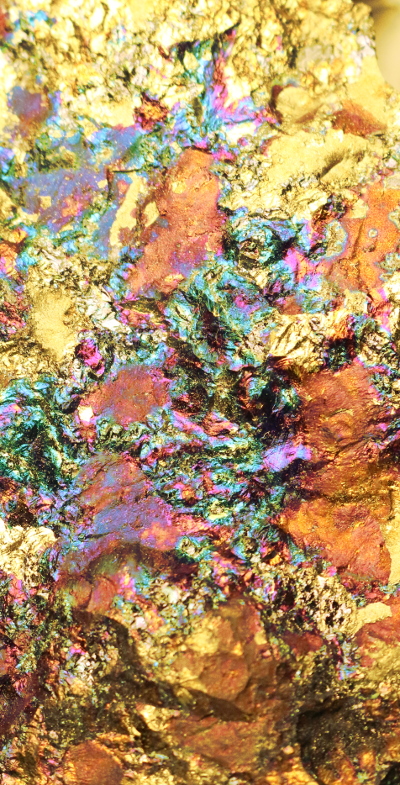

But the Paradise Papers reveal that Mr Gertler was called in to negotiate with DRC authorities several over 2008 and 2009 in relation to the struggling Katanga copper mine, when talks to secure a joint-venture agreement with DRC’s state-run miner Gécamines ground to a halt.

In 2009 Glencore took effective control of Katanga, but kept Mr Gertler’s interest in the company by secretly loaning his company, Lora Enterprises, $45 million in shares so that he would take part in a loan offer for Katanga and help secure an ongoing mining license.

“Glencore shall use its vote at the board of Katanga to have Dan Gertler exclusively mandated to assist Katanga in finalising the terms of the joint venture agreement,” one of the finance documents shows.

The loan included a provision for it to be recalled if the mining agreement was not secured, stating it would be “immediately repayable on demand” if the deal “is not finalised within three months”.

Mr Gertler’s lawyers have doused all claims.

“Mr Dan Gertler is a respectable businessman who contributes the vast majority of his wealth and time to the needy and to different communities, amounting to huge sums of money. He transacts business fairly and honestly, and strictly according to the law,” they said in a statement.

Glencore has issued a statement saying the loan to Lora “was made on commercial terms negotiated at arms length”, and was fully repaid by Lora in 2010.

Even before the Paradise Papers, Glencore’s record was far from clean, having been accused of financial and accounting manipulations, dealings with rogue states and other unsavoury behaviour.

Glencore bought Mr Gertler out of shared assets in DRC for $534 million in February this year, which was widely seen as an attempt to disassociate itself from Mr Gertler.

Print

Print